Wednesday, December 30, 2020

Don't ask me to celebrate what I don't agree with!

Tuesday, December 29, 2020

It can't be that long - can it?

I am on my daily morning walk and decided that the sabatical has been long enough!

So, the start is writing my thoughts.... do you know it was over 3 months ago since I have done this... over 3 months!

No wonder I am out of sorts... even though I am fully functional I am apparently not... just what has 2020 done to us all? I spoke with a friend [Bernard K] and he said the biggest hassle with "retirement" was relevance... and after 18 months of the chang and then in hibernatione I have to agree.

Cruise speaking was the plan but 1 month of it saw me unsatisfied then the Covid-19 situation saw cruiing stopped... so anyway you slice it, it didn't work out... it is unsatisfying but maybe I need to talk to the audience[?] than in hibernation?

[ for those not up on this I did 1 month on Spectrum of the Seas on its maiden vovage from Barcelona to Singapore]

Ah well 2021 should be better [?]

#Reboot,#WayneMansfield, #Experienceoracle, #PowerRead,#Done

Friday, August 14, 2020

The tide is turning!

You can only be "offend" for so long before it comes back to bite you.

Check latest news on:

Ellen

Black Life Matters

Epstein

etc..

Wednesday, July 29, 2020

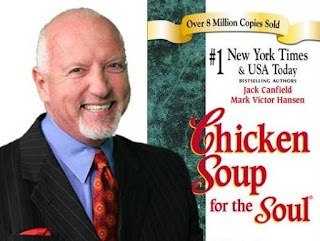

Chicken Soup for Soul series...

I met Mark again when I went to Los angelos for a conference with Jay Abrahams... he had dropped the "Dr" by now and was just getting started with the Chicken Soup books. Again he didn't do it for me but hey who am I to say... so MVH is one of the world's greatest known Personal Motivation Gurus and he didn't do anything for me... I have also met many others who have left positive impressions... like Denis Waitly, Zig and Art Linkletter... to name a few.

Tuesday, July 28, 2020

The Value of a Rescue dog!

Today the rain was heavy enough to cause new smells everywhere so so mch sniffing and little walking was had... but the ownwea seemed happy enough.

Isn't it strange how we reward dogs more than people?

Monday, July 27, 2020

How long can Daniel Andrews Last?

For some reason, he seems to be coated in teflon... nothing seems to stick!

At least it isn't the Big V crushing us in AFL footy!

Sunday, July 26, 2020

Is Retail Dead?

Only one of my previous haunts has returned to offering a lunch special [ $14.50 for a RumpSteak ] whilst the other two are charging $38 for a steak running through to $50.

The good place is 2 Forty 3 in Coventry Village Morley.

There is no table service so all three missed out on the sell up of coffee, an extra wine and maybe a extra course... and even when asked they missed the cue... you have to go up and order! Even when each venue has a wireless POS machine... are well, when they go broke I wonder what the excuse will be?

Saturday, April 18, 2020

How much of your investments are in Cash?

Now I know that I am a high risk investor and that nearly all my invested capital was in my businesses that I reasoned I had 100% control but "she who must be obeyed" had all her investments in bank accounts [cash] so I said "about half"

My client was happy with the answer with him saying "that's good I am about the same."

Fast forward to 2020, my buinesses have had their values stripped to zero by The Donald, The Virus and "The Black Dog" and "She how must be objeyed" has all her CASH but is bitterly complaining about the lack of interest she is earning.

The last share I bought were in Bond Corporation because I truly believed he could walk on water, but they [The Bond Corporation shares] sank to zero very quickly and Alan went to jail... The good part of the story it cured my share buying days instantly and permanently. I haven't purchased shares in a company that I had no influence on the management team since.

Earlier this week I asked whether you thought we would "snap back" and there was a 50/50 split and some very deep and meaningful answers. Personally, I think we are going to hell in a hand basket BUT sometime things will get better - different but better!

What will happen in the future? I think nobody knows.

All this sounds doom and gloom but the World Economy recovered from WW1, WW2, the Cold War, the Great depression, The Spanish Flu, 9/11, the GFC etc and I have no reason to believe this won't be the same... there will be many "Motivated sellers of distressed businesses" and not many willing purchsers, so there will be bargins a plenty and I feel that there will be a generational change in wealth and I am planning I will be on the right side of the shift.

Project 2025 was born in better times but it is now more likely to succeed... you should allocate some risk funds [the money you throw at the ponies or buy lotto tickets with] and jump on board... the ride will be fast, bumpty but ultimately rewarding.

Do you want o join me in Project 2025!?

Wednesday, April 15, 2020

Do you think The Economy Will "Snap Back?"

The big story over the last few days has been ‘reopening the economy’.

Wayne Mansfield

Sunday, April 12, 2020

Not in my life time

I have irrational feeling about petrol especially when it was $1.69 a litre but this week [ end of March / early April 2020] I saw it at 87.9c/litre and todays paper says it might get to as low as 70c/litre

Thursday, April 09, 2020

There is a bear in there!

There is a bear in there!!

From early morning walks...

Tuesday, March 03, 2020

Yes I remember that!

Pride of place in thousands of homes WORLDWIDE

On sunday, when killing time as I sometimes do, I wandered around a local Flea market and there was a full set of EB for $5.00 which I am sure was more for the book case than the books.

A simple question: What else did you have that now no longer exists in any meaningful way... like a film camera or a fax machine for example.

I was contemplating what will disappear due to our reaction to the Coronavirus?

Over to you?

#WayneMansfield

#SMM2020

#AussieIcon

#Coronoavirus

Sunday, March 01, 2020

Jack Ma of Alibab fame says the current crisis is a time to retool, reflect and prosper!

“Reflect on what you really want, what you have, and what you need to give up, or stick to,” Ma said.

Ma told students to “learn digital working methods” and “adopt internet technology.” Alibaba launched its Taobao online shopping platform in 2003 when China was locked down during a nationwide outbreak of the severe acute respiratory syndrome, or Sars.

Taobao is now the world’s largest e-commerce website, reporting 3 trillion yuan (US$428 billion) in transaction volume in 2017 with its Tmall.com sibling site.

Ma then channelled Kyocera Corporation’s founder Kazuo Inamori, whose management and leadership turned the television component maker into one of Japan’s largest companies.

At the age of 77 in 2010, Inamori – three years into his retirement at Kyocera – was asked to become the chairman and chief executive of Japan’s flag carrier Japan Airlines as it headed into bankruptcy protection. The carrier was restructured, and re-listed on the Tokyo Stock Exchange in November 2012.

Inamori had five strategies for companies during times of recession, according to Ma:

Strategy One: Every employees should turn to sales

Every employee should turn to sales, to arouse latent demand among clients, Ma cited Inamori in saying.

“Even in a company with tip-top technology, selling a product is still the foundation of the company’s operation,” Inamori said. “It is impossible to get orders during recessions if employees lack the spirit in making all-out efforts for clients.”

Strategy Two: Spare no effort to develop new products

A recession is a golden opportunity for companies to innovate and expand sales.

“Clients are too free during a recession. They will also propose new ideas after listening to yours. This would create orders that you never imagined before, so that you can expand your business.”

Strategy Three: Radical cost cuts

Recession is the only chance to cut costs, as every employee would strive to make it happen, Inamori said.

“You need to lower the break-even point of the whole company by making efforts to reduce production costs,” Inamori said. “If a company can maintain profitability when the turnover is halved, it would be even more profitable when sales returns to normal.”

Strategy Four: Maintain high production rate

Companies should maintain their usual high productivity rate even in times of recession, by reassigning excess labour from the production line to other tasks to maintain the cadence and vibe of the work cycle. “Once productivity drops, it would not be easy to restore,” Inamori said.

Strategy Five: Establish favourable interpersonal relations

“The most important thing for managing a company is the relationship between the manager and employees,” Inamori said, adding that employers must “love and protect” employees, while employees need to understand the manager, they need to help and support each other.

So, it is time to build on the opportunites that will surely come in the next few weeks and months...

All the best and may you prosper!

#JackMa

#WayneMansield

#CoronaVirus

#SMM2020

Tuesday, February 18, 2020

Holden Toast?

The last of a line!

But wait what about people with Holden in their DNA - well they will get over it! But there will be pain!

Number 1 always falls over but ALWAYS!

IBM was number 1 until it wasn't, Pan Am was number 1 until it wasn't... Ansett was number 1 until it wasn't. General Motors in Australia was number 1 until Toyota grabbed the crown and just wait it won't be number 1 forever. Who says Hyundai or Kia will grab that crown??

The Law of Nature is at work everywhere!

#Holden,

Thursday, February 06, 2020

Cockroach upsets virus quarantine victim SERIOUSLY[?]

The econmic consequences for Western Australia will be severe - for each $1 of iron pricing per tonne, the Government getts $83 million in tax... and already the price is down $13 a tonne, or in revenue, nearly $1 billion give or tak a few $$$$'s OUCH that might hurt.

Yesterday, I was looking at real estate to take advantage of the downturn... a unit in the Eastern Suburbs where the owner was offering 3 years settlement with possession in the meantime... it was shit - poorl;y built, by a builder who cut corners, and has now folded... but hey it was cheap!

It reminded me of a previous client, let's call him Rod to protect the innocent, who tripled his inome in Real Estate during one of the previoous busts in Perth real estate... he said the change came from swivlng in his chair so he looked at properties in South Perth which were in the millions from where he was selling, Vic Park, where propertis were in the $100k's. He said to me, the deals were the same just a few more 000 on the asking price BUT he still had to leand the purchaser the $10 to make the contract legal...

So, I think I will swivel my chair a bit.

{ as I just said to my agent... I am looking for a snatched back bentley rather than a clapped out commodore [ do they make them any more?]

So, ther e must be some great bargains at the big end of town? I am thinking!

Thursday, January 16, 2020

...and another one bites the dust - JeansWest calls in administrators

with the future of its 146 stores uncertain.

The company employs 988 staff in stores across all states and territories — including 40 stores in New South Wales, 32 stores in Victoria, 28 in Queensland and 23 in Western Australia.

Administrators from KPMG have been appointed and say Jeanswest will continue to operate as they consider "all options for the restructure or sale" of the business.

"Like many other retailers, the business has been challenged by current tough market conditions and pressure from online competition," said James Stewart from KPMG.

Jeanswest opened its first store in Perth in 1972 and expanded to the east coast.

Sunday, January 12, 2020

On Line 2020 Version

Home is in a state of flux... we had a power outage on Friday evening and our modem decided not to reconnect - try licving ina place where everything that can be is connected and then suddenly it isn't... you realise how much has changed since the internet was a "human right"

So, before I do the rest of my walk I will do some contemplation here where the wifi is free.

#WayneMansfield

#AussieIcon

#Project2025

#SMM2020